Grievances

Introduction

Shankar Fininvest Pvt Ltd is a Non-Banking Financial Company (NBFC) registered with the Reserve Bank of India (“RBI”). As a responsible financial institution committed to ethical business practices and regulatory compliance, Shankar Fininvest Pvt Ltd places the highest priority on providing transparent, fair, and customer-centric services.

In line with its mission to uphold the highest standards of customer satisfaction and financial integrity, the Company acknowledges that a robust grievance redressal mechanism is an integral part of corporate governance and financial services delivery. This mechanism is designed not only to address customer complaints, concerns, and disputes but also to identify systemic gaps and ensure continuous improvement.

This Grievance Redressal Policy (“Policy”) is formulated in accordance with the applicable provisions of the RBI Master Directions on NBFCs, the Fair Practices Code, and the Reserve Bank – Integrated Ombudsman Scheme, 2021. The Policy aims to provide a structured, transparent, and responsive process for resolving customer grievances while ensuring regulatory adherence, customer protection, and institutional accountability.

The Policy underscores Shankar Fininvest Pvt Ltd unwavering commitment to uphold trust, enhance service efficiency, and ensure that all customer interactions are addressed in a timely, fair, and equitable manner. It also ensures that customers are informed about their rights, the available redressal mechanisms, and the proper channels to escalate their concerns.

Policy Objective & Guiding Intent

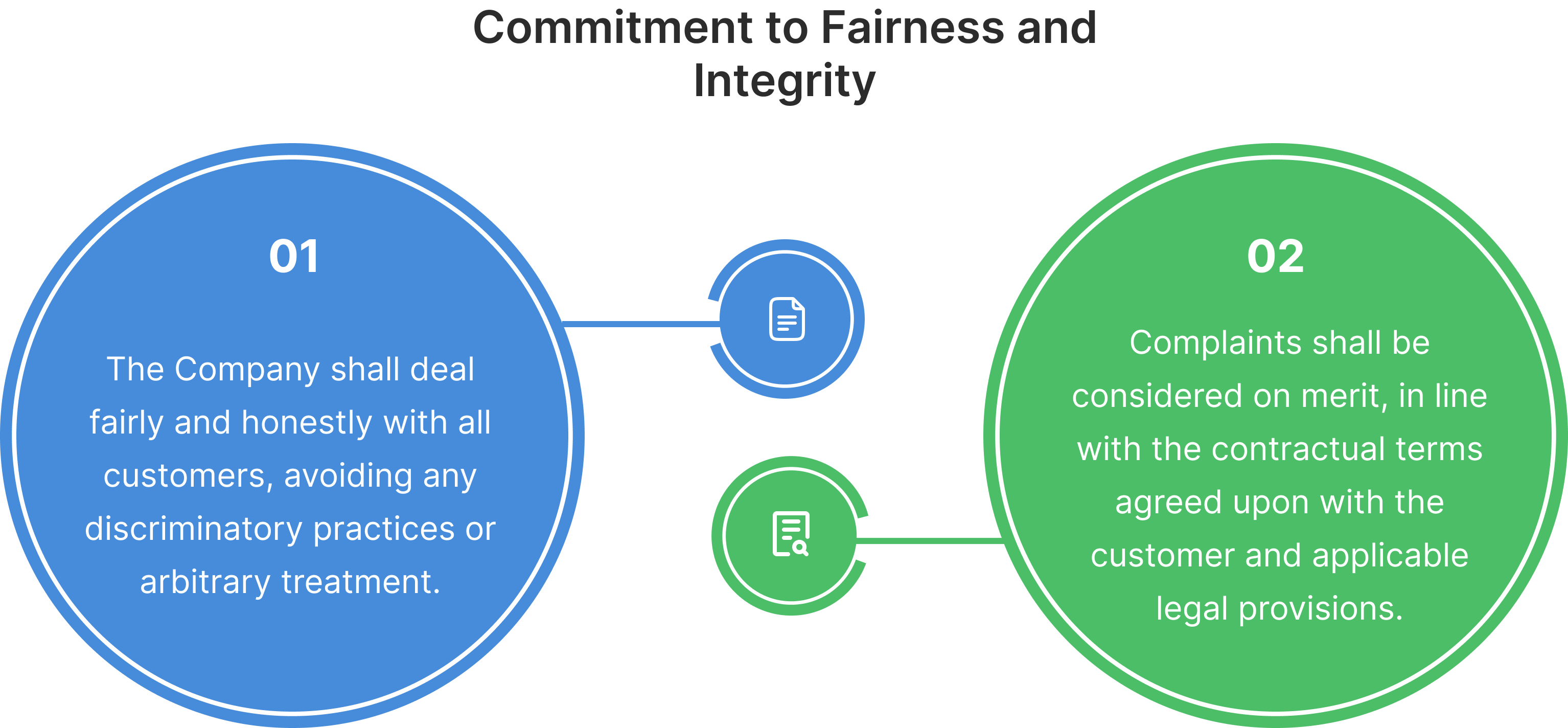

Ensure Fairness and Equity: To guarantee that every customer is treated with dignity, fairness, and impartiality, irrespective of their socio-economic background, financial status, or the nature of their complaint.

Establish a Formal Redressal Framework: To define a well-structured and transparent grievance handling process across all business units, ensuring clarity in roles and responsibilities.

Promote Accountability and Efficiency: To fix accountability on designated officers for timely resolution of complaints and ensure that customer grievances are handled by competent, trained personnel.

Regulatory Compliance: To comply with the guidelines and instructions issued by the RBI from time to time relating to the redressal of customer grievances, customer protection, and financial consumer rights.

Customer Empowerment: To create awareness among customers about their rights, the standard of service they can expect, and the procedure for lodging complaints through appropriate channels.

Systemic Improvements: To monitor recurring complaints, conduct root cause analysis, and implement corrective and preventive actions to improve processes, policies, and systems.

Facilitate Escalation Mechanisms: To establish a time-bound escalation matrix including recourse to the RBI Ombudsman in cases where customers are dissatisfied with the Company's internal resolution process.

Policy Scope & Coverage Parameters

PRINCIPAL GOVERNING GRIEVANCE REDRESSAL

This Policy is comprehensive in its application and encompasses the following dimensions:

.png)

.png)

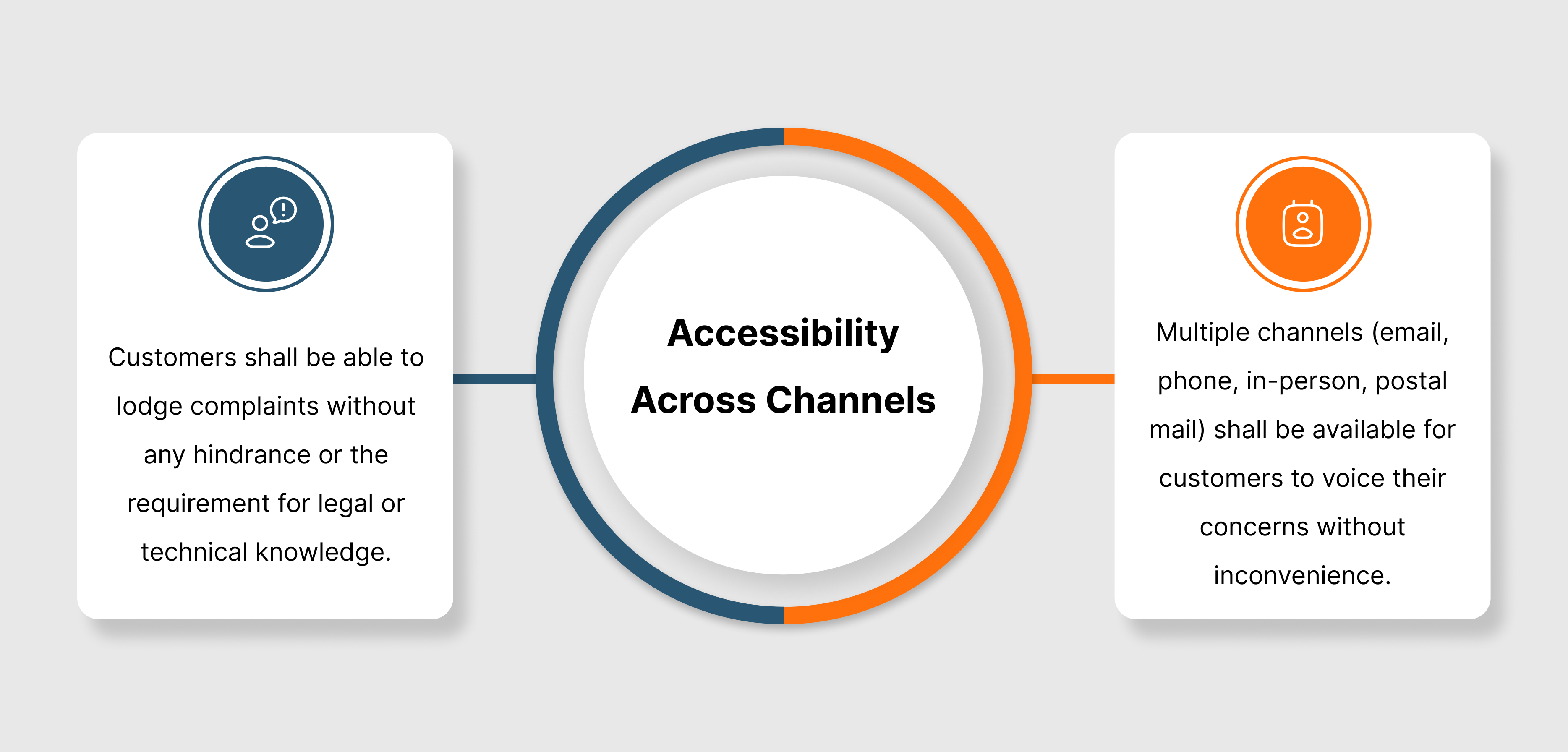

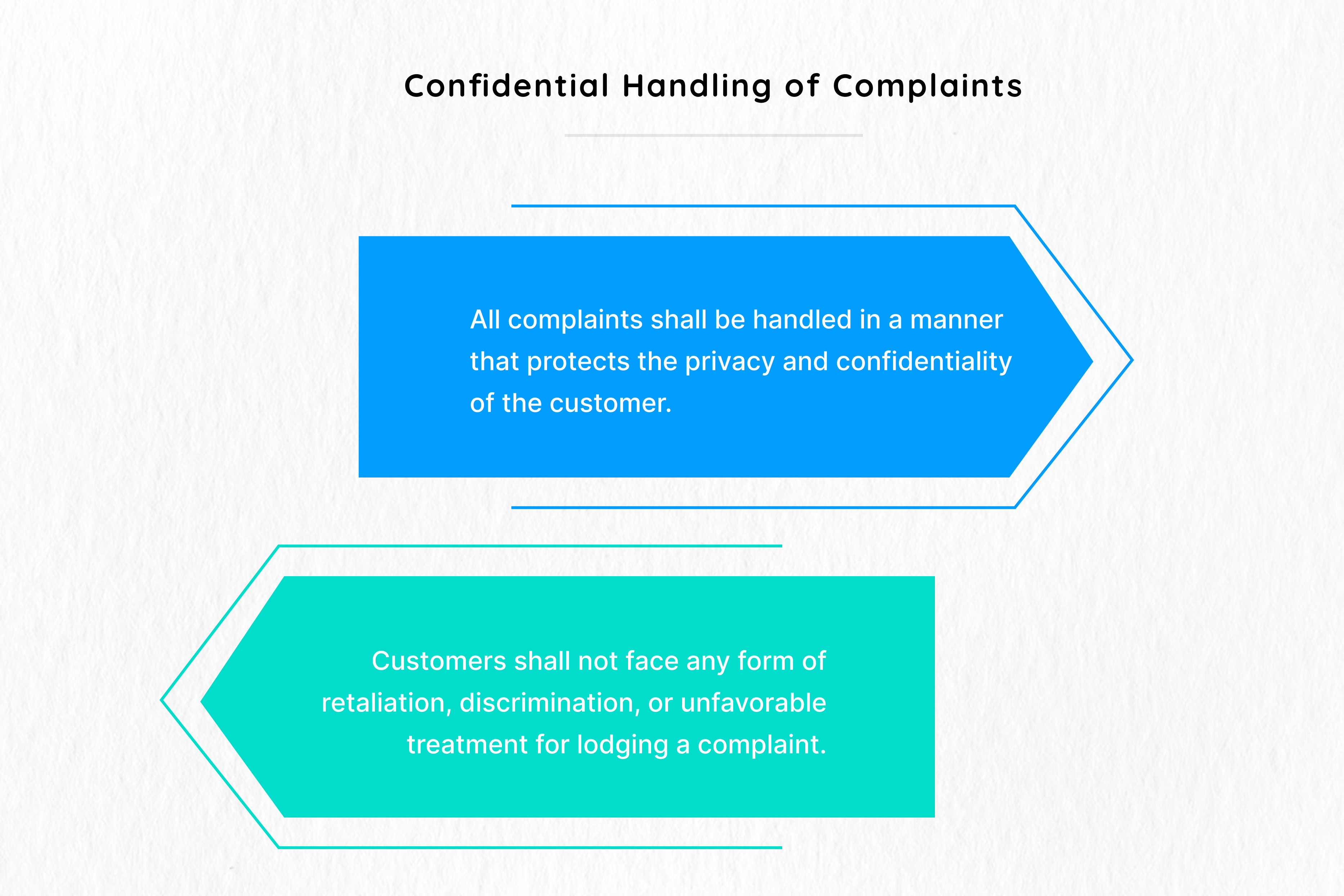

Confidential Handling of Complaints

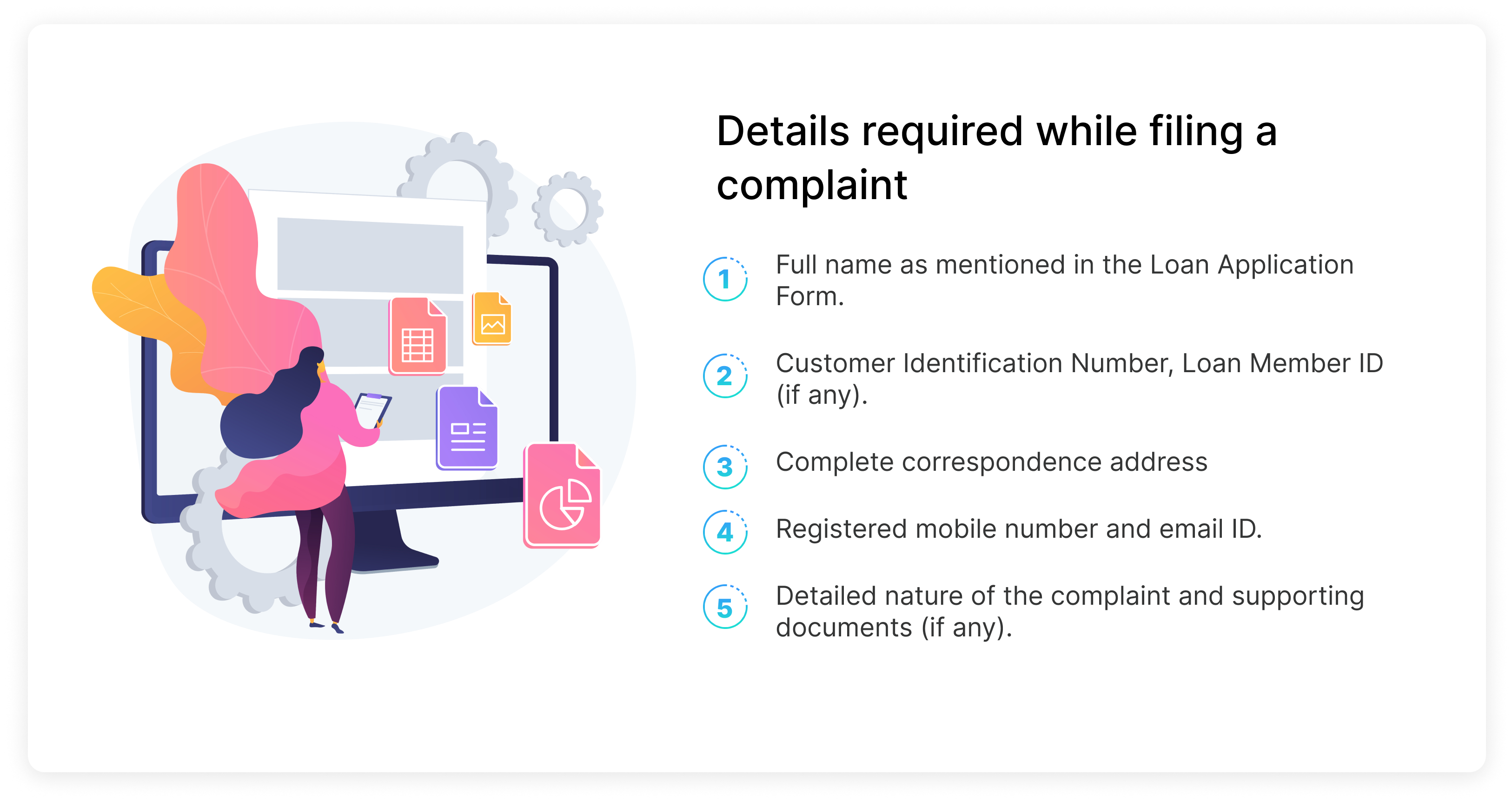

Customers may raise complaints on the following grounds, among others

Non-receipt or delayed issuance of loan sanction letters, agreements, or related documentation.

Uncommunicated changes in loan terms or interest rates.

Incorrect debits, unauthorized charges, or service fees.

Misrepresentation or misconduct by any employee or agent.

Delay in payment processing or non-issuance of receipts.

Inaccurate reporting to credit bureaus (CIBIL/Experian/CRIF, etc.).

Breach of data privacy or misuse of customer information.

Non-compliance with RBI's Fair Practices Code or NBFC guidelines.

Grievance Redressal Timeframe

| Type of Complaint | Resolution Timeframe |

|---|---|

| General service-related complaints | Within 15 working days |

| Payment-related complaints | 24 hours |

| Credit Information / CIBIL-related | 24 hours |

| Legal / fraud / investigative cases | 30 working days |

Note: Delays beyond the above timelines shall be communicated to the customer with reasons and expected resolution dates.

Staff Conduct and Behavioural Concerns

Complaints involving misbehavior, harassment, or unprofessional conduct by staff or representatives are treated with zero tolerance. Such grievances are investigated promptly, and strict disciplinary or contractual actions are taken where misconduct is established. The complainant is informed of the resolution while ensuring confidentiality and fairness.

Operational or Transactional Issues

These relate to service delays, document issuance, account discrepancies, or payment-related issues. Such complaints are handled by the operations or customer care teams and resolved through backend verification and correction. Escalation is made to senior management if unresolved at the branch or departmental level.

Complaints Involving Outsourced Agents

Where a complaint involves outsourced agencies (e.g., collection agents), the Company takes full ownership of resolution. Corrective action is taken against the third party if found responsible, and customers are not redirected.

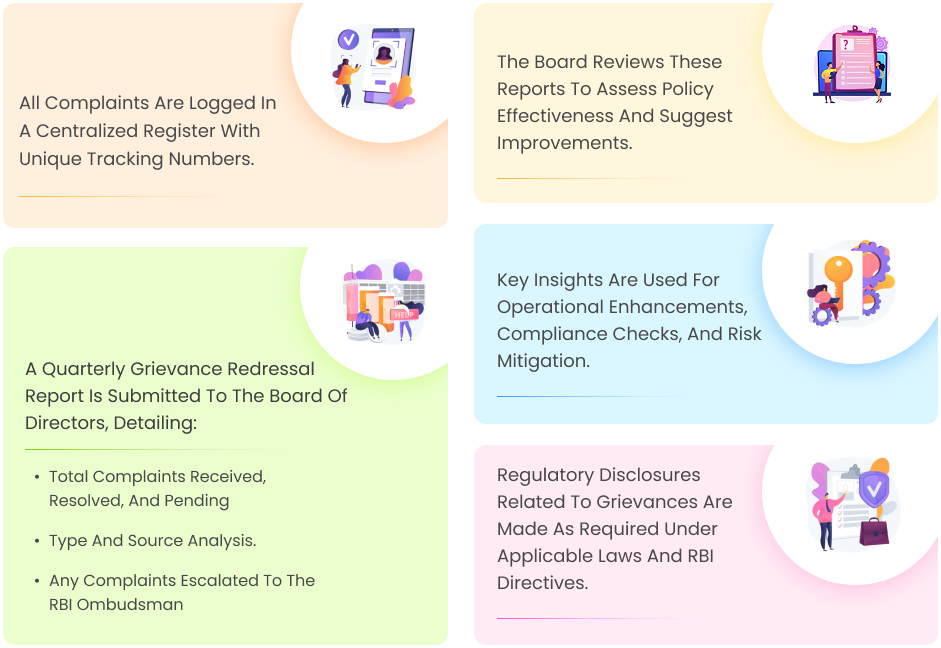

INTERNAL REPORTING AND GOVERNANCE OF GRIEVANCES

Grievance data is systematically recorded and monitored to ensure transparency and accountability.

.png)